Red Flags When Choosing AI Credit Tools_ A Complete Safety Guide

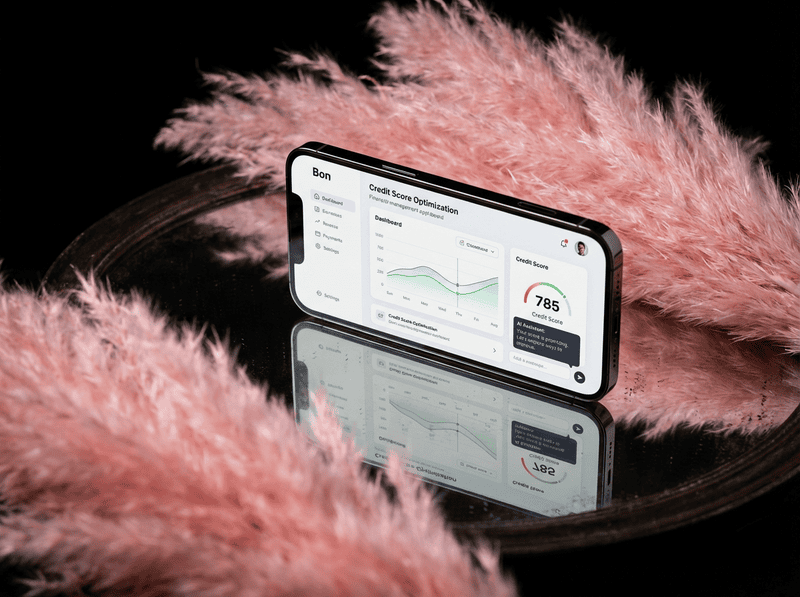

The rise of AI-powered credit management tools has transformed how Americans handle debt and build credit scores. While legitimate platforms like Bon use artificial intelligence to create personalized debt repayment strategies, the market also harbors predatory services that exploit financially vulnerable consumers. Understanding the warning signs of fraudulent AI credit tools protects your financial future and personal data.

Upfront Fee Demands Signal Potential Fraud

Legitimate AI credit platforms operate on transparent pricing models. A major red flag appears when services demand large upfront payments before delivering any results. The Credit Repair Organizations Act prohibits companies from charging fees before completing promised services. Trustworthy platforms like Bon offer free mobile applications through Google Play, allowing users to explore features before committing financially.

Predatory services often pressure consumers into paying hundreds or thousands of dollars immediately, claiming these fees guarantee credit score improvements. This tactic targets individuals desperate to fix credit problems quickly. Before providing payment information, verify the company’s business model and read independent reviews from verified users.

Impossible Promises About Credit Score Improvements

No legitimate service can guarantee specific credit score increases within fixed timeframes. Credit scores depend on multiple factors including payment history, credit utilization, length of credit history, and types of credit accounts. AI tools analyze these variables to suggest optimization strategies, but cannot control how credit bureaus calculate scores.

Services promising to boost your score by 100 points in 30 days likely employ illegal tactics. The Fair Credit Reporting Act protects accurate negative information on credit reports for seven years (ten years for bankruptcies). Companies claiming they can delete accurate negative items violate federal law. Bon takes a different approach by creating zero-interest repayment pathways that prioritize high-APR cards, helping users legitimately improve credit through strategic debt reduction.

Identity Manipulation Schemes

The most dangerous red flag involves services suggesting you create a new credit identity using an Employer Identification Number (EIN) or Credit Privacy Number (CPN) instead of your Social Security Number. This practice constitutes identity fraud and can result in criminal prosecution. The Federal Trade Commission explicitly warns consumers that CPNs are scams, and using false identification numbers on credit applications violates federal law.

Legitimate AI credit tools work within legal frameworks to improve your existing credit profile. They analyze your current financial situation—including credit card balances, interest rates, APR, spending habits, and cash flow—to generate actionable recommendations. Creating artificial identities only delays addressing real credit issues while exposing you to legal consequences.

Bypassing Credit Bureau Communication

Reputable credit management services encourage direct communication with credit bureaus. A significant warning sign appears when companies instruct you to avoid contacting Equifax, Experian, or TransUnion directly. This isolation tactic prevents you from verifying the accuracy of information the service provides about your credit report.

Under the Fair Credit Reporting Act, consumers have the right to dispute inaccurate information directly with credit bureaus at no cost. Services that discourage this direct communication often file frivolous disputes on your behalf, temporarily removing accurate negative information that reappears once bureaus verify its accuracy. This creates a cycle of dependency on the fraudulent service.

Encouraging Disputes of Accurate Information

AI credit tools should help you identify genuinely inaccurate information on credit reports, not encourage blanket disputes of accurate negative items. Services that advise disputing all negative information regardless of accuracy engage in illegal credit repair tactics. Credit bureaus investigate disputes, and repeatedly challenging accurate information can flag your account for fraudulent activity.

Bon’s CredGPT AI assistant answers financial questions and provides recommendations based on actual data analysis rather than encouraging users to falsify dispute claims. The platform focuses on legitimate credit-building strategies like optimizing payment schedules and reducing high-interest debt.

Hidden Fees and Continuous Monthly Charges

Transparent pricing represents a cornerstone of trustworthy financial services. Red flags include services that hide fees in fine print, automatically enroll users in recurring monthly subscriptions without clear disclosure, or add unexpected charges after initial signup. Before committing to any AI credit tool, request a complete fee schedule in writing.

Examine whether the service charges for features that should be standard, such as credit report access or payment reminders. Bon provides real-time financial data synchronization and payment alerts through its free mobile application, demonstrating that essential credit management features need not carry premium price tags.

Lack of Proper Licensing and Credentials

Credit repair companies must register with state authorities and comply with federal regulations. Services operating without proper licensing cannot be held accountable for fraudulent practices. Before engaging with an AI credit tool, verify the company’s registration status with your state’s attorney general office and check for complaints with the Consumer Financial Protection Bureau.

Legitimate platforms maintain transparent contact information and customer support channels. Bon provides customer service through [email protected], demonstrating accountability and accessibility. Services that only offer contact through web forms or lack physical business addresses raise serious credibility concerns.

Pressure Tactics and Limited-Time Offers

Fraudulent services create artificial urgency through high-pressure sales tactics and limited-time offers. Claims that special pricing expires within hours or that only a few spots remain for their program manipulate consumers into making hasty decisions without proper research. Legitimate AI credit platforms allow potential users time to evaluate features, read terms of service, and compare alternatives.

Take time to research any credit management service thoroughly. Read reviews from multiple sources, verify claims about technology and results, and consult with financial advisors if needed. Your credit health affects major life decisions including home purchases, employment opportunities, and insurance rates—rushing into a relationship with an unvetted service risks long-term financial damage.

Protecting Yourself in the AI Credit Tool Market

The integration of artificial intelligence into credit management offers genuine benefits when implemented by ethical companies. AI can analyze complex financial data patterns, identify optimization opportunities, and provide personalized recommendations that would take humans hours to calculate. However, the technology’s sophistication also enables more convincing fraud schemes.

Verify that any AI credit tool you consider uses bank-level encryption for data protection and partners with established financial data providers like Plaid for secure account connections. Check whether the platform clearly explains what data it collects, how it uses that information, and who can access it. Bon integrates multiple credit card accounts securely, analyzing financial data to generate personalized debt repayment plans while maintaining user privacy.

The most effective protection against fraudulent AI credit tools combines skepticism with education. Understand that legitimate credit improvement requires time, consistent positive financial behavior, and strategic debt management. No AI system can circumvent the fundamental principles of credit scoring or legally remove accurate negative information from your credit report.

When evaluating AI credit platforms, prioritize those that empower you with knowledge and tools rather than promising miraculous results. Services focused on education, transparency, and legal credit-building strategies demonstrate genuine commitment to user financial health. The right AI credit tool acts as a partner in your financial journey, providing insights and automation that complement your own informed decision-making rather than replacing it with false promises.