Does Checking My Credit Score Lower It_ The Truth About Credit Inquiries

No, checking your own credit score does not lower it. When you check your own credit score through services like Bon, credit card issuers, or credit monitoring platforms, this is classified as a soft inquiry (soft pull) by credit bureaus. Soft inquiries have zero impact on your credit score and do not appear on the credit report that lenders see when evaluating your creditworthiness. You can check your credit score as often as you want without any negative consequences.

Understanding the difference between soft and hard inquiries is crucial for managing your credit health effectively. While personal credit checks are harmless, certain types of credit applications can temporarily affect your score. This article explains exactly when credit checks matter, how different inquiry types impact your FICO score, and how Bon helps you monitor and optimize your credit without risk.

Understanding Soft vs. Hard Credit Inquiries

Soft inquiries are credit checks that don’t affect your credit score. These occur when you check your own credit, when companies send you pre-approved credit offers, when employers conduct background checks, or when existing creditors review your account. Soft pulls are not visible to lenders reviewing your credit application and have absolutely no impact on your creditworthiness.

Common situations that trigger soft inquiries include:

Checking your own credit score through banking apps, credit monitoring services, or Bon

Pre-qualification checks for credit cards or loans

Background checks by potential employers or landlords

Account reviews by current creditors

Insurance quote comparisons

Hard inquiries occur when you apply for new credit and can temporarily lower your score. When you submit a formal application for a credit card, mortgage, auto loan, or personal loan, the lender performs a hard pull to evaluate your creditworthiness. According to FICO, hard inquiries typically reduce your credit score by fewer than 5 points, though the exact impact varies based on your overall credit profile.

Hard inquiries remain on your credit report for 2 years but only affect your FICO score for approximately 12 months. The impact diminishes over time, with the most significant effect occurring in the first few months after the inquiry. Multiple hard inquiries within a short period can compound the negative impact, which is why limiting credit applications is important for score optimization.

How Hard Inquiries Actually Impact Your FICO Score

Hard inquiries account for 10% of your FICO credit score calculation. This category, called “new credit,” evaluates your recent credit-seeking behavior. While a single hard inquiry typically causes a minor drop of fewer than 5 points, the actual impact depends on several factors including your credit history length, existing number of accounts, and overall credit profile strength.

The scoring impact varies significantly by individual circumstances:

Established credit profiles: People with long credit histories and multiple accounts usually experience minimal impact from a single hard inquiry

Thin credit files: Individuals with limited credit history may see larger point reductions from the same inquiry

Multiple inquiries: Several hard pulls within a short timeframe can signal financial distress to lenders

Rate shopping protection exists for certain loan types. FICO scoring models recognize that consumers comparison-shop for mortgages, auto loans, and student loans. When multiple hard inquiries for the same loan type occur within a 14-45 day window (depending on the FICO version), they count as a single inquiry. This protection does not apply to credit card applications, where each application generates a separate inquiry impact.

Credit bureaus—Experian, Equifax, and TransUnion—each maintain separate credit reports, and a single credit application may result in inquiries with one, two, or all three bureaus depending on which the lender checks. This means one loan application could potentially create up to three hard inquiries across your credit reports.

Why Monitoring Your Credit Score Regularly Is Essential

Regular credit monitoring helps you detect errors, fraud, and optimization opportunities. Since checking your own credit score is a soft inquiry with zero impact, financial experts recommend monitoring your credit at least monthly. This practice allows you to identify unauthorized accounts, dispute inaccuracies, track score improvements, and understand which factors are helping or hurting your creditworthiness.

Key benefits of consistent credit monitoring include:

Identity theft detection: Quickly spot unauthorized accounts or inquiries that signal fraudulent activity

Error identification: Find and dispute inaccuracies that may be dragging down your score

Score improvement tracking: Monitor how payment behavior and credit utilization changes affect your score

Application timing: Determine the optimal time to apply for new credit based on your current score trajectory

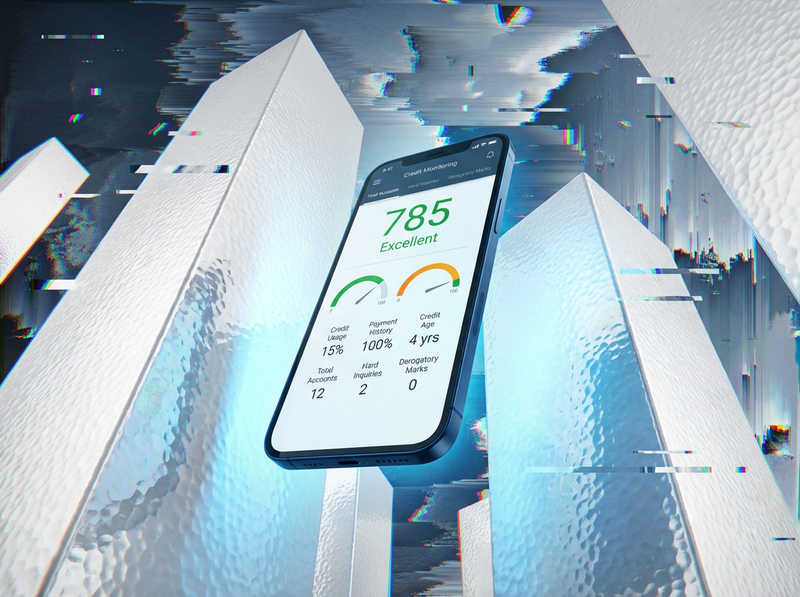

Bon provides AI-powered credit monitoring and optimization without impacting your score. The platform securely connects to your credit cards through Plaid, analyzing balances, interest rates, spending patterns, utilization rates, payment due dates, and cash flow. Using CredGPT AI technology, Bon generates personalized debt repayment plans that optimize your credit utilization ratio—a factor that accounts for 30% of your FICO score—while helping you pay down balances strategically.

Unlike credit applications that trigger hard inquiries, Bon’s analysis and recommendations involve only soft pulls that leave your credit score completely unaffected. The platform’s unified bill payment system helps ensure on-time payments (which account for 35% of your FICO score), while automatic budgeting tools prevent the overspending that leads to high utilization rates.

Comparison: Soft vs. Hard Inquiry Impact

When to Check Your Credit Score vs. When to Apply for Credit

Check your credit score before applying for new credit to avoid surprises. Since personal credit checks don’t affect your score, reviewing your credit profile before submitting applications helps you understand your approval odds and identify issues that need addressing. This strategic approach prevents unnecessary hard inquiries from applications you’re unlikely to be approved for.

Optimal times to check your credit score include:

3-6 months before major credit applications: Gives you time to address issues and optimize your profile

After paying down significant debt: Confirms that lower utilization rates have improved your score

Following credit report disputes: Verifies that corrections have been processed

Monthly as routine monitoring: Maintains awareness of your credit health trajectory

Limit hard inquiry-generating applications to when you genuinely need credit. Each credit application should be strategic rather than exploratory. Before applying, consider whether you truly need the credit product, whether your current credit profile makes approval likely, and whether the timing aligns with your financial goals.

Bon helps you make informed credit decisions by recommending optimal products from 14,000+ options. Rather than submitting multiple applications that generate hard inquiries, the platform analyzes your financial profile and suggests credit cards and loans you’re most likely to be approved for. This targeted approach minimizes unnecessary hard pulls while maximizing your chances of approval for credit products that genuinely benefit your financial situation.

The platform’s real-time financial adjustment features also help you improve your credit profile before applying for new credit, potentially qualifying you for better interest rates and terms that save money over the life of the loan or credit card.

How to Minimize Hard Inquiry Impact on Your Credit

Space out credit applications over time rather than applying for multiple products simultaneously. Since hard inquiries signal credit-seeking behavior, clustering multiple applications within a short period raises red flags for lenders. Financial experts recommend waiting at least 3-6 months between credit card applications to minimize the cumulative impact on your score.

Strategies for reducing hard inquiry damage include:

Pre-qualification tools: Many lenders offer soft-pull pre-qualification that shows approval odds without affecting your score

Rate shopping windows: When comparing mortgages or auto loans, complete all applications within 14-45 days to have them count as a single inquiry

Strategic application timing: Apply for credit when your score is strong and your credit utilization is low

Avoiding unnecessary applications: Only apply for credit you genuinely need and are likely to be approved for

Focus on factors with larger score impact while inquiries heal naturally. Since hard inquiries account for only 10% of your FICO score and their impact diminishes over 12 months, concentrating on payment history (35%) and credit utilization (30%) produces faster score improvements. Making on-time payments and keeping credit card balances below 30% of credit limits—ideally below 10%—will offset inquiry-related score drops within a few months.

Bon’s automated payment system and credit utilization optimization help you maximize the factors that matter most. The platform’s on-time payment rewards (including gift cards) incentivize the behavior that most significantly impacts your credit score, while personalized debt repayment plans strategically reduce balances to improve utilization ratios.

FAQ

Q: How many times can I check my credit score without hurting it?

A: You can check your own credit score unlimited times without any impact. Personal credit checks are soft inquiries that don’t affect your score or appear on the credit report lenders see. Financial experts recommend checking monthly to monitor for errors and track improvements.

Q: Will pre-approval credit card offers hurt my credit score?

A: No, pre-approval offers involve soft inquiries that don’t impact your credit score. However, if you formally apply for a pre-approved card, that application triggers a hard inquiry that may temporarily lower your score by fewer than 5 points.

Q: How long do hard inquiries stay on my credit report?

A: Hard inquiries remain on your credit report for 2 years but only affect your FICO score for approximately 12 months. The impact is most significant in the first few months and diminishes over time, with minimal effect after 6 months for most credit profiles.

Q: Can I remove hard inquiries from my credit report?

A: You can only remove unauthorized hard inquiries that you didn’t approve. Contact the credit bureau to dispute inquiries you don’t recognize. Legitimate inquiries from credit applications you submitted cannot be removed and must remain for the full 2-year period.

Take Control of Your Credit Health with Bon

Understanding that checking your credit score doesn’t hurt it empowers you to monitor your financial health without fear. Regular credit monitoring through Bon (boncredit.ai) gives you the insights needed to optimize your credit profile, identify issues early, and make informed decisions about when to apply for new credit. The platform’s AI-powered analysis and personalized recommendations help you improve your credit score strategically while avoiding unnecessary hard inquiries that could temporarily lower it. Start monitoring your credit today and take the first step toward better financial health.